Our Benefits Are Unbeatable

Join our Air Force NAF Team Today and Enjoy Unbeatable Benefits!

- Health and Life Insurance

- Retirement

- 401 (k) Savings

- Paid Annual and Sick Leave

- Tuition Assistance

- Flexible Spending

Air Force NAF Employee Benefits

Additional Employee Benefits

- Awards

- Workers & Unemployment Compensation

- Sunday Premium Pay

- Use of Morale, Welfare and Recreation Activities

- Discounts on Tickets & Vacations

- On Base Child Care

- Shop at the Exchange

Welcome New NAF Employees

There are two types of Non-appropriated Fund (NAF) positions: “flexible” and “regular.” Flexible employees have work schedules that depend on the needs of the activity. These employees may work a minimum of zero to 40 hours per week and do not receive benefits. Flexible employees fill temporary, seasonal, or fluctuating workforce needs. Regular employees work between 20 and 40 hours a week depending on position requirements, and are entitled to benefits.

Employees with regular appointments are eligible for the following benefits and compensation: Health and life insurance, awards, retirement plan, 401(k), annual leave, sick leave, military leave, administrative leave, maternity leave, paternity leave, and court leave, overtime pay, holiday pay, Sunday premium pay, shift differential, workers’ compensation, and unemployment compensation.

Employees with flexible appointments are eligible for the following benefits and compensation: Overtime pay, shift differential, awards, workers’ compensation, and unemployment compensation. A flexible NAF position may serve as a stepping stone to a regular full-time position with benefits.

Other Benefits: Generally, all Service programs (except dining facilities) may be used by individuals who contribute to the Air Force mission. Listed are some of the programs that may be available to you as an employee.

NAF Health Benefits

Air Force NAF health benefits are offered as part of the DoD NAF Health Benefits Program. Health benefits include medical, dental, vision, and prescription drug coverage. To view the 2024 Air Force Services Benefits click here.

Aetna offers three medical plans based on where you live. To view which of one of these you qualify for, click here.

Medical Plans

Participating in the DoD Health Benefit Plan has a lot of perks — starting with finding everything you need in one convenient place. Provided below are product guides, where you can access your complete health plan information.

Get more information on Aetna Health Plans here!

| Aetna High Deductible Health Plans ( HDHP) | Aetna Open Choice POS II | Aetna Traditional Choice Indemnity | Aetna International Indemnity | Aetna Stand- alone Dental |

|---|---|---|---|---|

| Aetna High Deductible Health Plan (HDHP) | Aetna Open Choice POS II Plan | Aetna Traditional Choice Indemnity Plan | Aetna International Traditional Choice Indemnity Plan | Aetna Stand-Alone Dental Plan |

2024 Premiums

Life Insurance Benefits

MetLife is the carrier for Air Force (NAF) Life Insurance Benefits. You may enroll for partially employer-paid Basic Term Life and Accidental Death & Dismemberment coverage, voluntary Supplemental Term Life insurance coverage, and Dependent coverage.

Basic Term Life and Accidental Death & Dismemberment Insurance (for regular employees only)

Basic Term Life and Accidental Death & Dismemberment (AD&D) insurance pays a benefit based on your yearly earnings. Basic Life coverage includes a matching amount of Accidental Death and Dismemberment insurance for you.

Supplemental Life Insurance

In order to enroll in Supplemental Life insurance, you must be a current employee and enrolled in Basic Life / AD & D coverage.

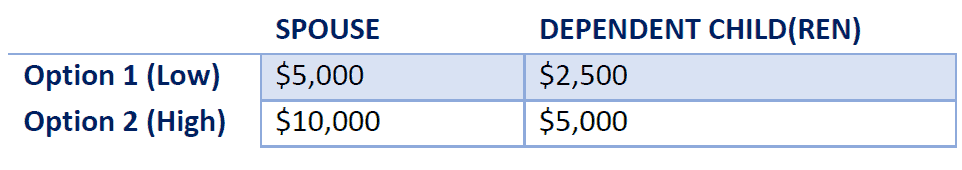

Dependent Group Life Insurance

Dependent Group Life insurance lets you cover your Spouse/Domestic Partner and unmarried dependent children. You have two dependent Group Life insurance coverage options, as shown in the chart. *Children may continue to be covered until age 25.

Visit the Air Force (NAF) Life Insurance website for more plan provisions and certificate details. Click here!

Health Care Accounts (FSA/HSA/HRA)

FSA

Flexible Spending Account (FSA)

The Health Care Flexible Spending Account

The Health Care Flexible Spending Account (HCFSA)

Dependent Care Flexible Spending Account

Dependent Care Flexible Spending Account (DCFSA)

How do I enroll in the NAF Health Care Programs?

You are eligible to participate if you are a regular NAF employee. You may enroll online during the annual Open Enrollment period at WageWorks.com. New employees may enroll within 31 days of hire or date becoming eligible. If you have questions, contact your local Human Resource Office.

Please note: You do not need to be enrolled in an employer-sponsored heath plan to enroll in FSA. Additionally, to continue your enrollment in FSA you must re-enroll every year.

Health Savings Account (HSA)

After you have enrolled in the HDHP, CONUS employees may be eligible to enroll in the HSA.* This account can be used to save money to pay for qualified health care expenses — now and in the future. The best part? The Air Force will make a contribution of $500 (for employee only coverage) or $1,000 (for family coverage) at the beginning of the year to get your account started. You, too, can contribute funds from your paycheck on a pretax basis. The account is yours to use and let grow for future health care costs. There is no ‘use it or lose it’ rule. Note: You may not have both an HCFSA and an HSA.

Health Reimbursement Account (HRA)

After you have enrolled in the HDHP, CONUS employees may be eligible to enroll in the HSA.* This account can be used to save money to pay for qualified health care expenses — now and in the future. The best part? The Air Force will make a contribution of $500 (for employee only coverage) or $1,000 (for family coverage) at the beginning of the year to get your account started. You, too, can contribute funds from your paycheck on a pretax basis. The account is yours to use and let grow for future health care costs. There is no ‘use it or lose it’ rule. Note: You may not have both an HCFSA and an HSA.

The Air Force NAF Retirement Plan

The NAF Retirement Plan only requires employees to contribute 1% of their bi-weekly pay while the plan administrator contributes the bulk of the cost. The monthly annuity is determined based on factors such as age, time and salary. This plan is voluntary, but we hope that all eligible employees will participate.

To be eligible to participate in the NAF Retirement Plan, you must be a civilian employee under regular appointment (excluding off-duty military) and be employed by an Air Force NAFI Instrumentality in the United States (U.S.), or if employed outside the U.S., be a U.S. dollar-paid citizen, permanent resident or noncitizen national of the U.S. You may enroll upon completion of 12 months of regular Air Force NAF service. If you enroll within 30 days of when you are first eligible, those 12 months are included in credited service.

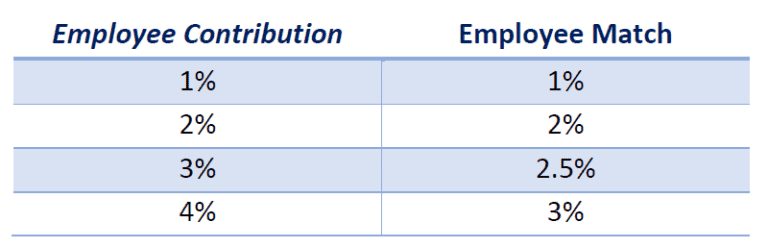

The Air Force 401 (k) Savings Plan

All regular Air Force NAF employee who is a U.S. citizen, a U.S. National or permanent resident alien of the U.S. and is on the U.S. Dollar payroll is eligible to participate in the Air Force NAF 401(k) Savings Plan after you have met the eligibility waiting period of 30 days of Air Force NAF regular service. You can make a pretax contribution of up to 92% of your compensation, subject to annual IRS limits. By participating in the plan you receive two tax breaks. First, your contribution are tax deductible. The money you contribute does not count toward your gross income for that tax year, which reduces or lowered your taxable income. Second, your earnings on your investment grows tax deferred. In addition to the tax benefit your Air Force Employer will match you contribution percentage up to 3% (See table below). Taking control of your financial health is an important factor in saving for retirement. There are articles and tools within your Principal Account Dashboard to help you create a plan and take steps toward abetter retirement. Employee Contribution 3%